REAL TIME NEWS

Loading...

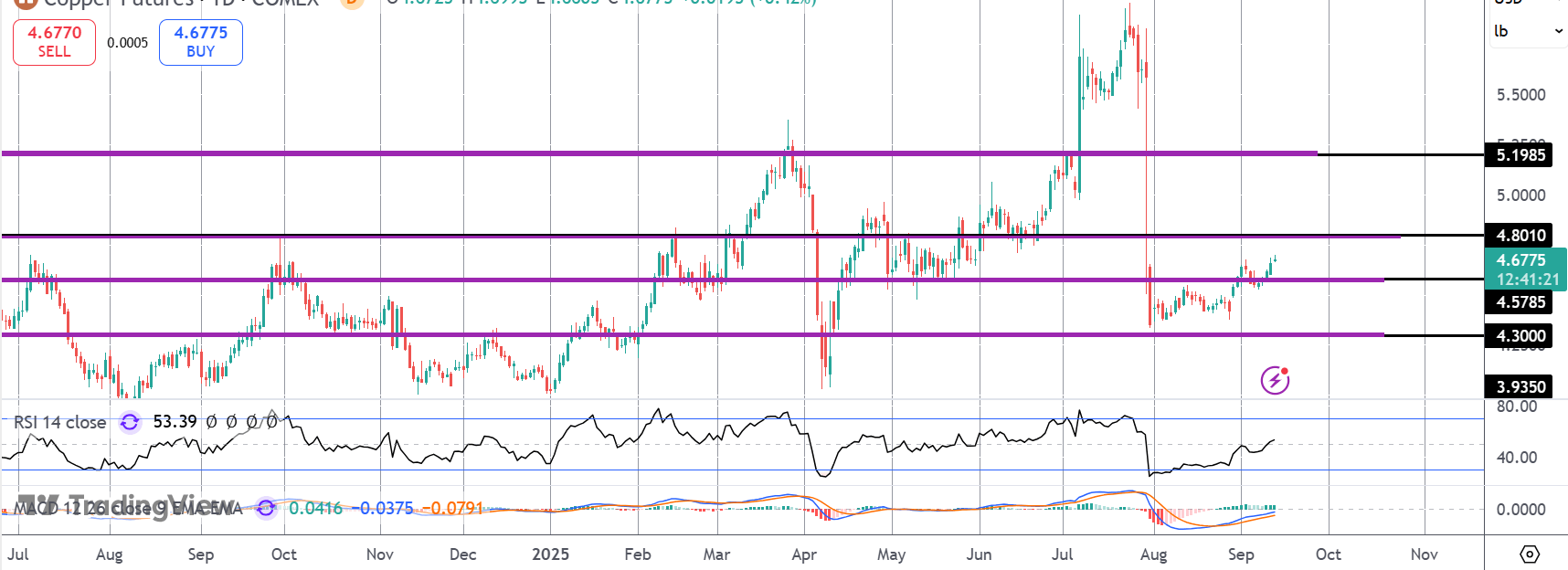

Crude Rally PausesCrude prices are a little softer today with momentum stalling for now on the back of yesterday’s push higher. The futures market hit its highest level since October earlier in the session before sell interest took hold. A sharp downturn in USD is ...

Crude Rally PausesCrude prices are a little softer today with momentum stalling for now on the back of yesterday’s push higher. The futures market hit

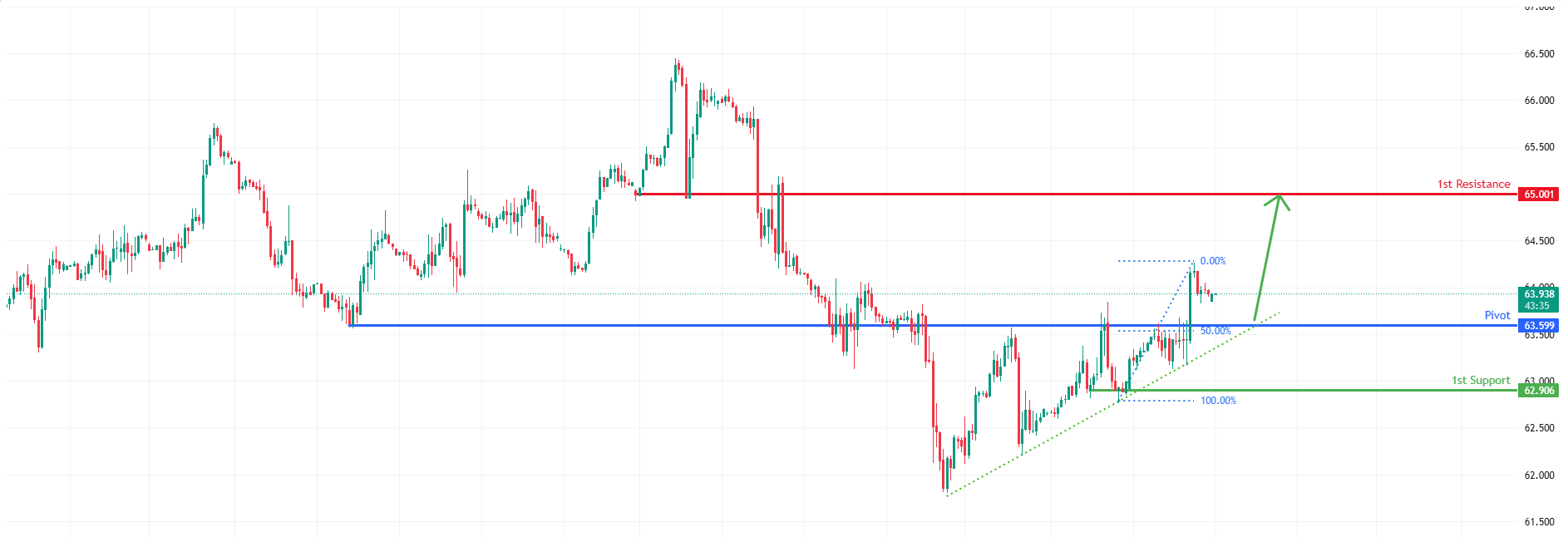

Title USOUSD M30 | Bullish momentum buildingType Bullish bouncePreference The price is falling towards the pivot at 61, which is an overlap resistance that aligns with the 38.2% Fibonacci retracement. A bounce from this level could lead the price toward the 1st res...

Title USOUSD M30 | Bullish momentum buildingType Bullish bouncePreference The price is falling towards the pivot at 61, which is an overlap resistance

Daily Market Outlook, January 28, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The financial markets are certainly paying attention to Donald Trump. After a prolonged period of calm in the foreign exchange space, the curren...

Daily Market Outlook, January 28, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…The financial markets are cer

Title EURGBP H4 | Bearish continuationType Bearish reversal Preference The price is rising towards the pivot at 0.8727, an overlap resistance. A reversal at this level could lead the price toward the 1st support at 0.8656, a multi-swing low support. Alternative Sce...

Title EURGBP H4 | Bearish continuationType Bearish reversal Preference The price is rising towards the pivot at 0.8727, an overlap resistance. A rever

Big picture: what changedThe report frames this week as a potential “gear shift” in the USD story:Volatility has risen sharply; price action is being amplified by cash + options flows.Trump’s comments are treated as an explicit comfort with USD weakness, unnerving ...

Big picture: what changedThe report frames this week as a potential “gear shift” in the USD story:Volatility has risen sharply; price action is being

SP500 LDN TRADING UPDATE 28/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6880/70WEEKLY RANGE RES 7065 SUP 6928FEB OPEX STRADDLE 6726/7154MAR QOPEX STRADDLE 6466/7203DEC 2026 OPEX ST...

SP500 LDN TRADING UPDATE 28/1/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEA

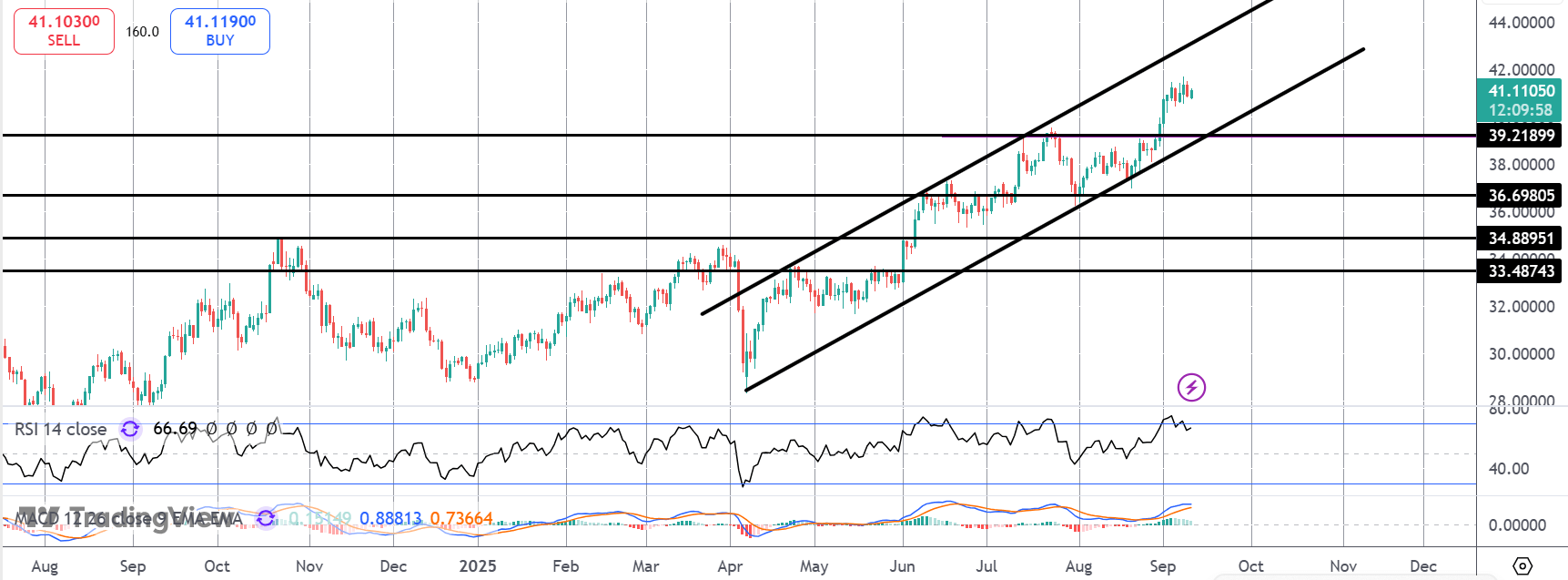

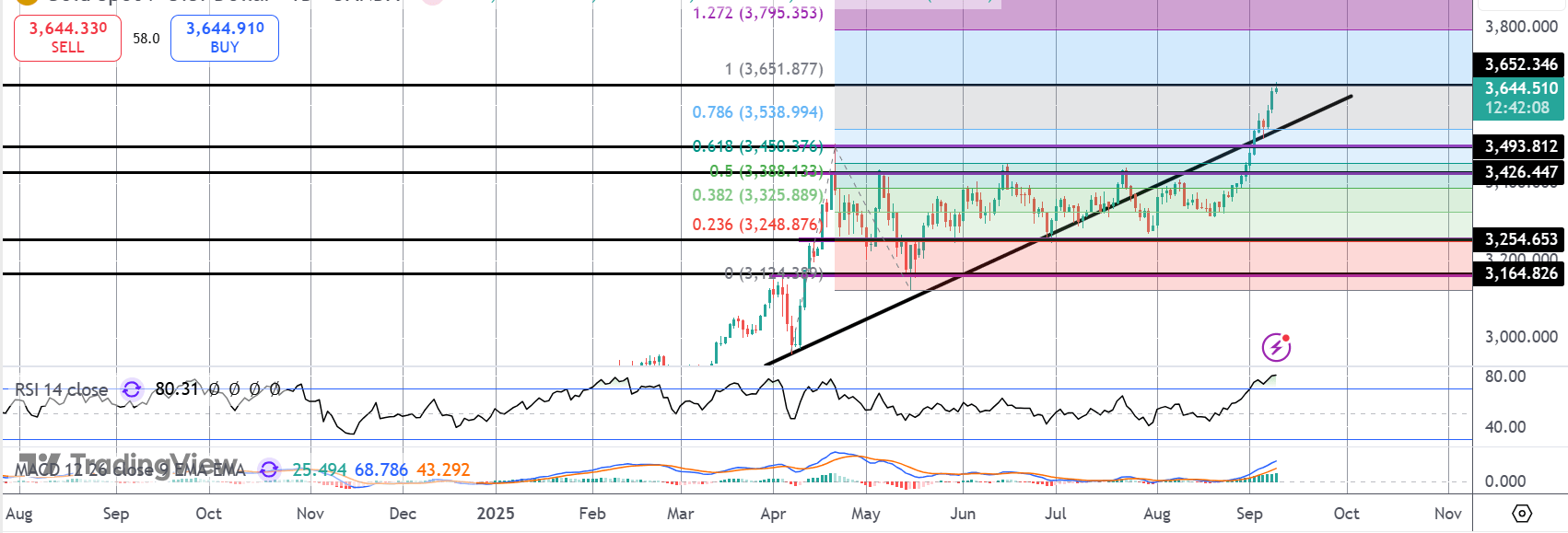

Gold SoaringGold prices are continuing to soar higher midweek with the safe-haven benefiting from the collapse in USD. The Dollar has plunged amidst worsening US sentiment and speculation that the Fed was involved in joint intervention with the BOJ at the end of la...

Gold SoaringGold prices are continuing to soar higher midweek with the safe-haven benefiting from the collapse in USD. The Dollar has plunged amidst w

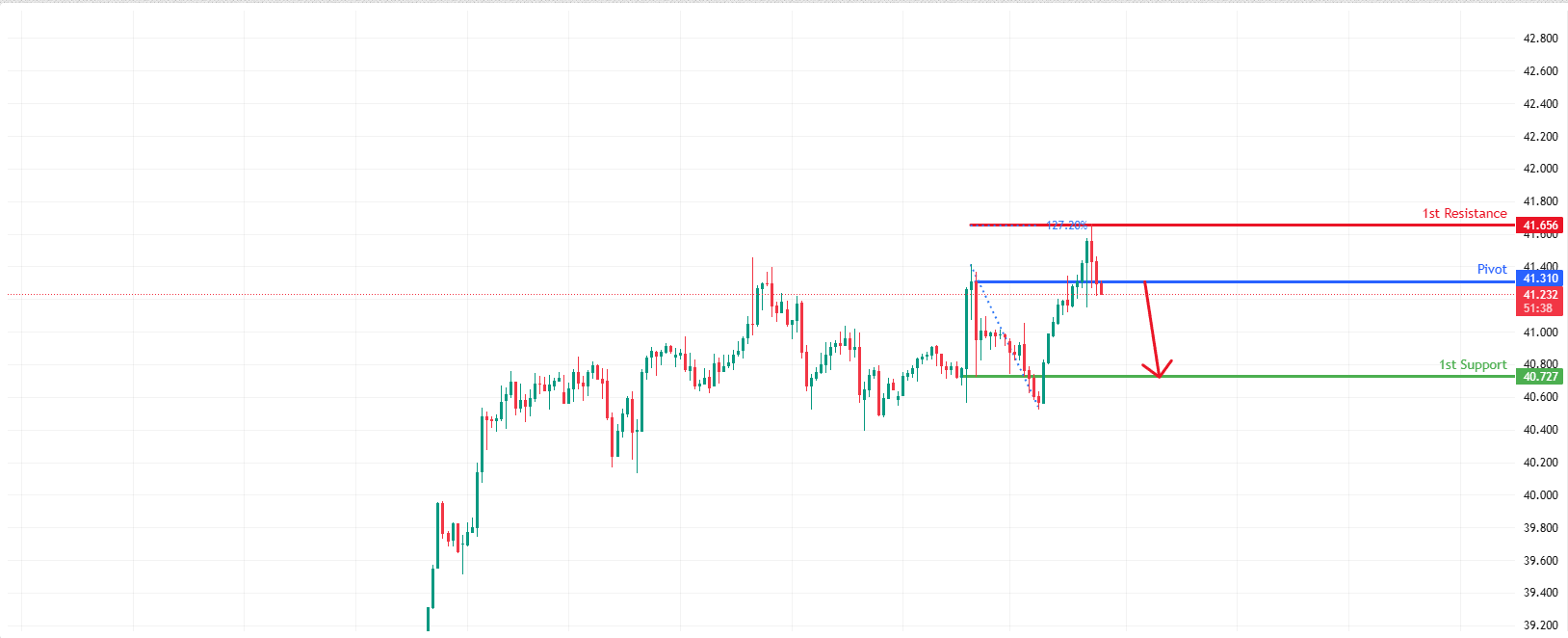

Title EURJPY H4 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling toward the pivot at 181.66, which is an overlap support that aligns with the 127.2% Fibonacci extension. A bounce from this level could lead the price toward ...

Title EURJPY H4 | Bullish reversal off overlap support Type Bullish bounce Preference The price is falling toward the pivot at 181.66, which is an ove

FTSE 100 FINISH LINE 28/1/26The UK’s leading stock market index, the FTSE 100, suffered losses on Wednesday, weighed down by declines in banking and healthcare stocks. Investors analysed corporate earnings reports while closely monitoring the U.S. Federal Reserve&#...

FTSE 100 FINISH LINE 28/1/26The UK’s leading stock market index, the FTSE 100, suffered losses on Wednesday, weighed down by declines in banking and h

Goldman Sachs Chart of the Day: Gamma Wall“It feels like SPX keeps failing at SPX 7,000…”One reason for this is the extreme SPX gamma positioning by market makers. Goldman Sachs futures strategists estimate $6 billion of long gamma at spot, which increases to $12 b...

Goldman Sachs Chart of the Day: Gamma Wall“It feels like SPX keeps failing at SPX 7,000…”One reason for this is the extreme SPX gamma positioning by m