Dollar Rallying As FOMC Minutes & NFP Eyed

DXY Bid on Monday

The US Dollar is looking a little firmer today as we kick off a big week for the greenback. With the US govt shutdown resolved, we’ll finally start to see those postponed readings start to come through with Thursday’s September NFP report the headline release this week. Ahead of that we’ll also have the FOMC minutes on Wednesday night along with a slew of Fed speakers across the week.

Shifting Easing Expectations

Market pricing for a December rate cut has fallen dramatically, now back below the 50% level from as high as 95% ahead of the last FOMC meeting. This repricing was sparked by hawkish warnings from Powell at the FOMC who noted that a December cut was not a foregone conclusion, citing uncertainty and division among policymakers as a result of the lack of data available during the shutdown. Despite this hawkish shift, however, there is still plenty of room for a dovish reversal if incoming data highlights fresh weakness. In particular, labour market readings and inflation data will be the key readings to watch.

NFP On Watch

Looking ahead to Thursday’s NFP data, the market is looking for +50k on the headline NFP reading with the unemployment rate to hold steady at 4.3%. If seen, this will do little to inspire doves and should keep USD supported near-term. Given that Wednesday’s FOMC minutes are likely to be hawkish too, any bullishness in Thursday’s jobs data should see USD firmly higher by the end of the week. On the other hand, if we see a surprise undershoot in the data, this could help cap any USD bullishness seen on the back of the Fed minutes though, due to the delayed release, it will likely take fresh weakness in the October report to properly drive rate-cut expectations higher.

Technical Views

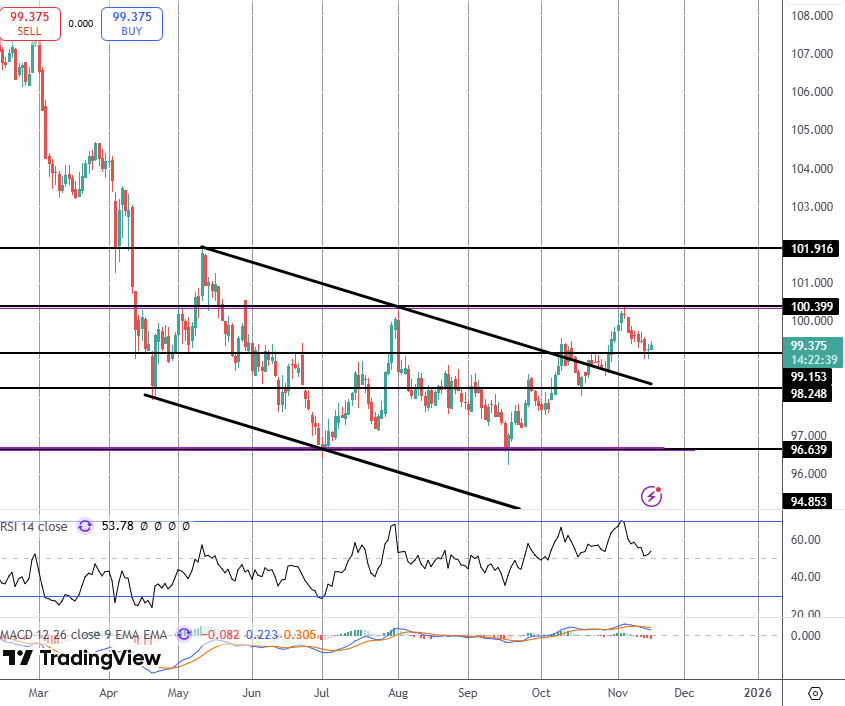

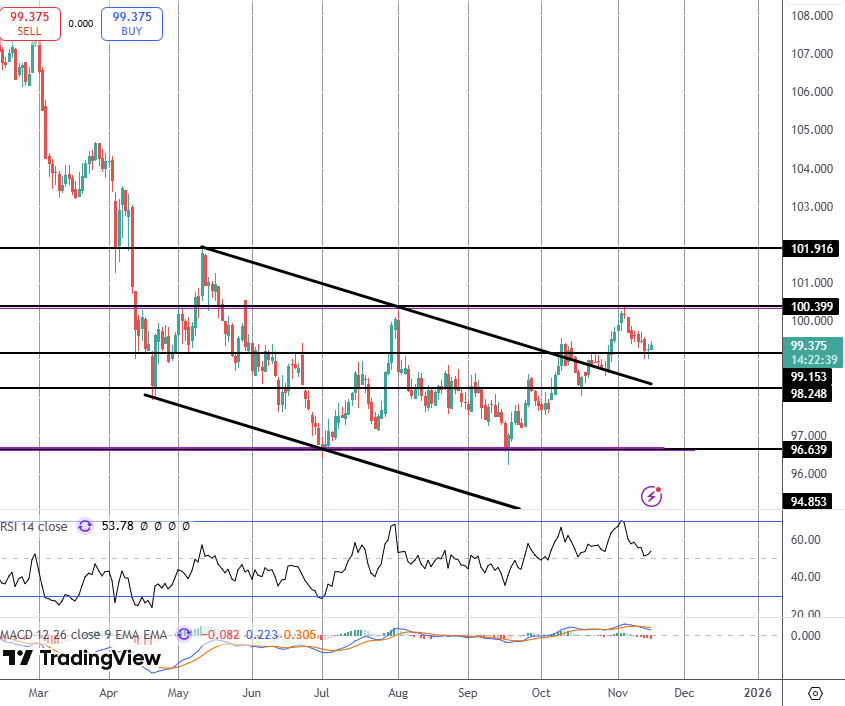

DXY

The correction lower has found fresh demand into a retest of the 99.15 level for now. While this level holds, and price remains above the broken bear channel, focus is on a fresh push higher with the 100.39 mark the key resistance to note. A break of that level should encourage fresh momentum towards 101.91 next. Should we slip lower, however, 98.24 and the channel retest will be the key support area to watch

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.