FTSE 100 FINISH LINE 10/11/25

FTSE 100 FINISH LINE 10/11/25

On Monday, UK stocks climbed, mirroring the bullish sentiment in global markets amid growing optimism that the historic U.S. government shutdown might soon be resolved. Meanwhile, Diageo stole the spotlight with a remarkable surge after announcing its new CEO. Shares of Diageo, the world’s leading spirits producer, soared by 7.2%, marking their most significant single-day jump in five years. The boost came as the company revealed that Dave Lewis, the former Tesco boss, would be stepping into the CEO role.

Global markets experienced a surge as the U.S. Senate took steps to reopen the federal government, effectively ending the shutdown. Meanwhile, UK stocks faced a weekly decline on Friday, as a selloff in high-performing U.S. tech stocks sent ripples through global markets. Adding to the mix, the Bank of England maintained interest rates, as widely anticipated. In a closely contested vote, hints emerged that Governor Andrew Bailey might soon align with those advocating for a rate cut. This raised hopes for a potential policy shift in December, following the unveiling of the government's budget. Looking ahead, investors are set to focus on third-quarter GDP figures and a fresh wave of corporate earnings reports this week. On a brighter note, UK miners enjoyed gains, with precious metal miners climbing 4.5% and industrial metal miners rising 1.9%, driven by gold reaching a two-week high and copper prices trending upward.

Diageo, the renowned spirits producer, saw its shares surge by 7.2%, hitting 1,851p, after announcing Dave Lewis as its incoming CEO. This impressive rally positioned the stock as the top performer on the FTSE 100 index, which itself rose by 0.71%. Lewis, who currently serves as Chair of consumer healthcare company Haleon, is set to take the helm at Diageo starting January 1, 2026. He will succeed interim CEO Nik Jhangiani, who will return to his previous role as CFO after his temporary leadership concludes at the end of December. In response to Lewis’s departure from Haleon, the healthcare group has appointed Vindi Banga as its new Chair. However, Haleon's shares dipped by 1.1% following the announcement. Despite today's boost for Diageo, the company’s stock remains down 27.23% year-to-date, contrasting sharply with the FTSE 100 index's impressive gain of 19.3% over the same period.

Shares of London-based financial services company JTC have taken a hit, dropping nearly 4.7% to 1,292p. Despite this, the FTSE mid-cap index is up 0.68% today, making JTC the biggest loser on the index. The decline comes after JTC agreed to a fourth revised acquisition offer from British private equity firm Permira. The deal values the company at £2.3 billion ($3.09 billion). As part of the agreement, JTC shareholders will receive 1,340p per share in cash, which is a slight 1.3% discount compared to Friday's closing price of 1,358p. Despite today’s dip, JTC shares have seen impressive growth this year, with gains of 31.5% year-to-date.

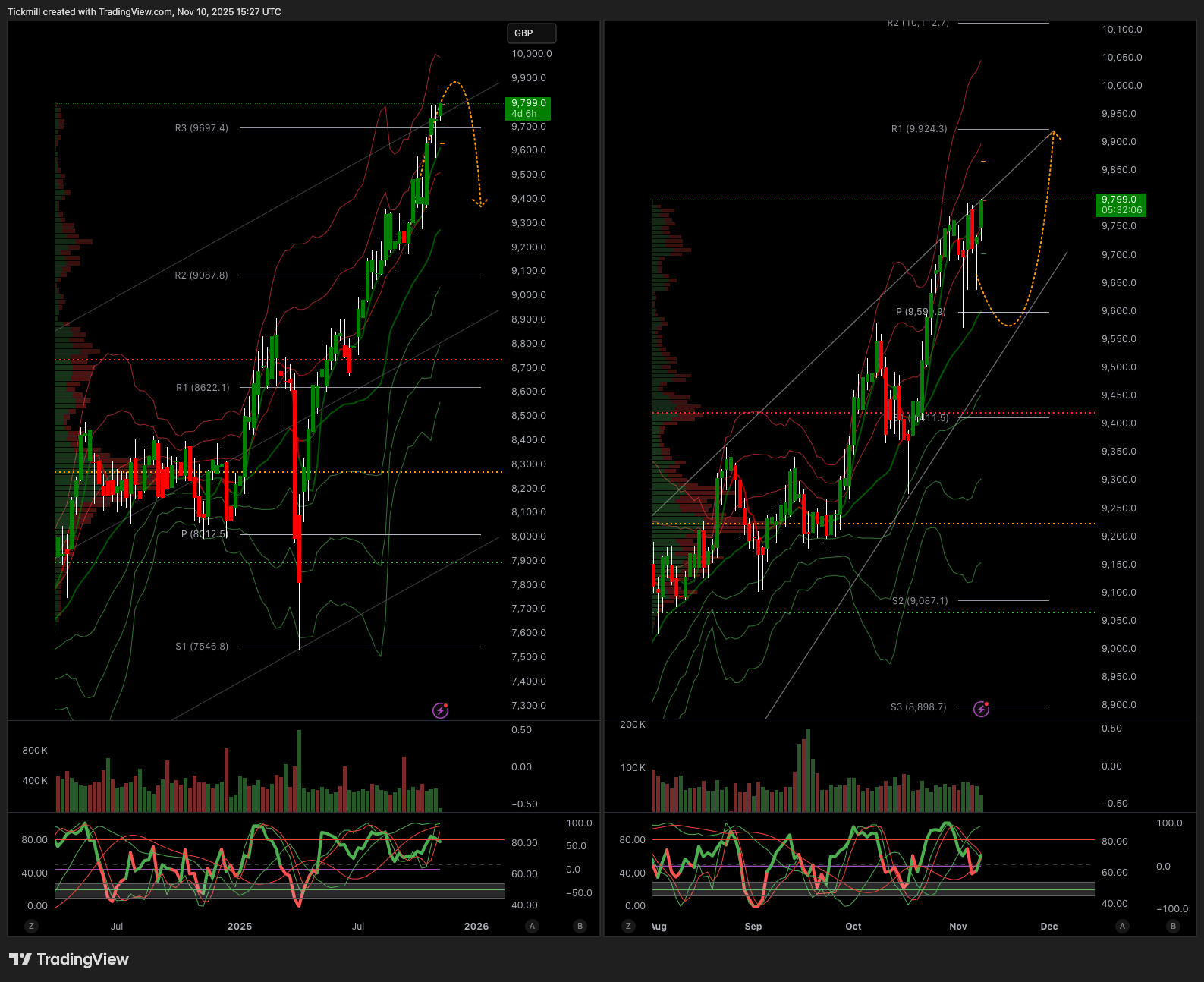

TECHNICAL & TRADE VIEW - FTSE100

Daily VWAP Bearish 9740

Weekly VWAP Bullish 9612

Above 9740 Target 9897

Below 9730 Target 9600

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!