Huge FX Moves As USD Breaks Down

Major USD Shift

We’re seeing seismic moves across FX markets this week with the US Dollar coming under heavy selling pressure yesterday. The DXY broke down to its lowest levels since early 2022, fuelling a significant repricing across major trading pairs. The move hasn’t been attributed to any clear single driver more a continued decline in investor sentiment towards the US. The general consensus is that investors are wary of holding US Dollars at the moment due to the unpredictable nature of US policy under Trump. Lingering geopolitical risks around the globe as well as growing domestic discontent over ICE-killings mean that USD is falling form favour as safe-havens and other assets soar.

FOMC in Focus

Looking ahead, focus now turns to the FOMC later today. The Fed is widely expected to keep rates on hold while signalling a more neutral outlook near-term (reduced Q1 rate cut chances). If USD fails to rally in response to this message, this will give insight into how weak the market is here. Indeed, on the outside chance that we hear any dovish signalling from the Fed, this could see USD push firmly lower again. Any rally today on the back of the FOMC is likely to prove short-lived given the broader market themes at play and should simply provide an opportunity for USD bears to reload at better levels.

Technical Views

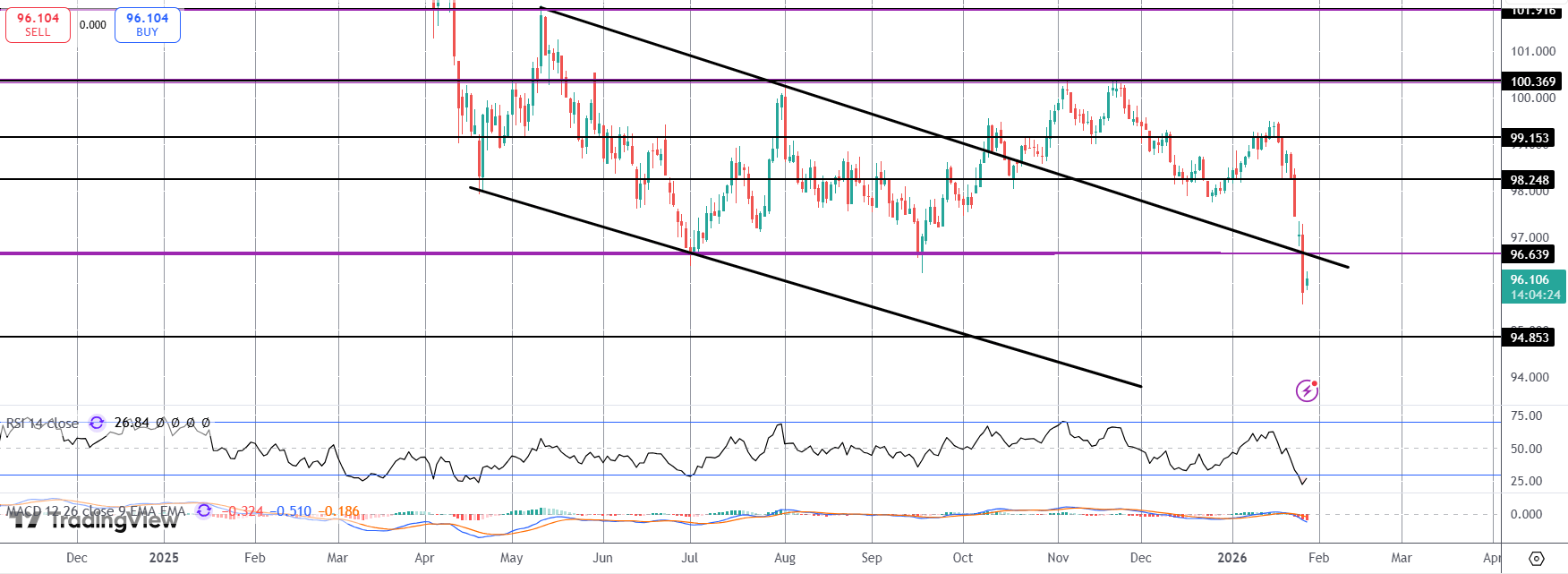

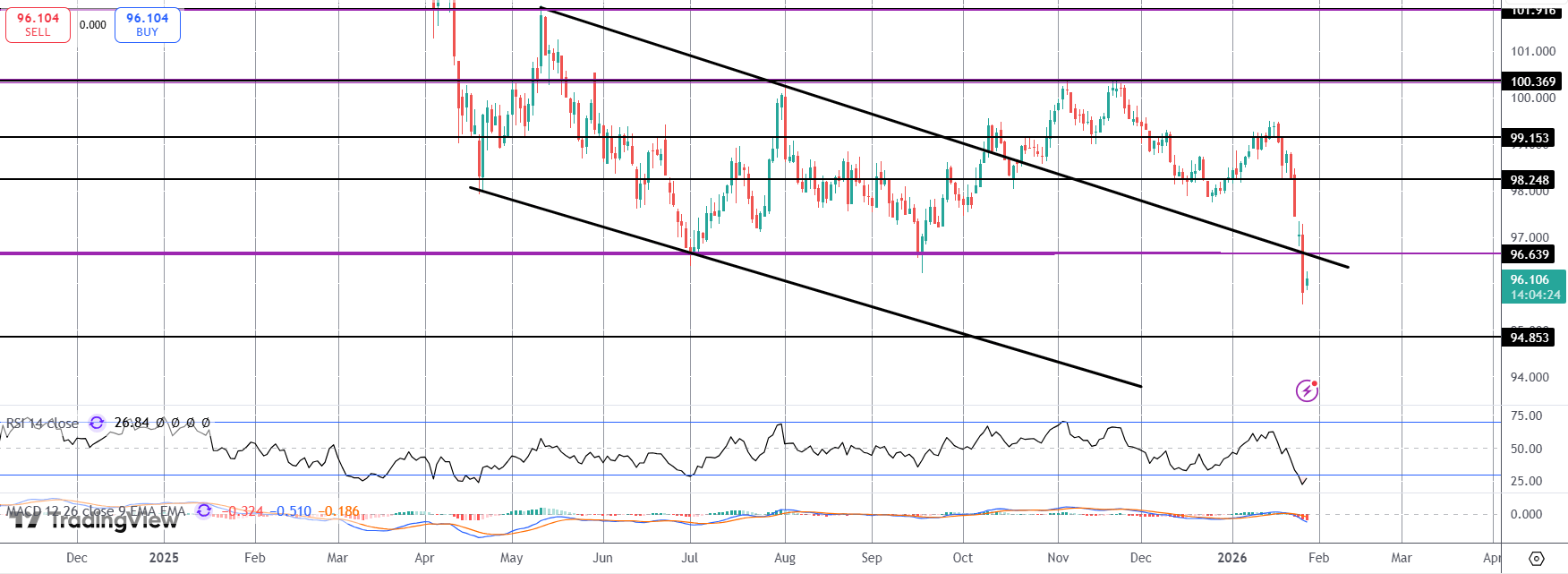

DXY

The sell off in DXY has seen price breaking down below the 96.63-level support and back inside the bear channel. While below this level, focus is on a continuation lower towards the 94.85 level next in line with bearish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.