Institutional Insights: Nomura Cross-Asset 'Trend Shock..'

Nomura Cross Asset Management - US equity indices (SPX / NDX / QQQ / RUT)** actionable positioning, hedging, and triggers.

---

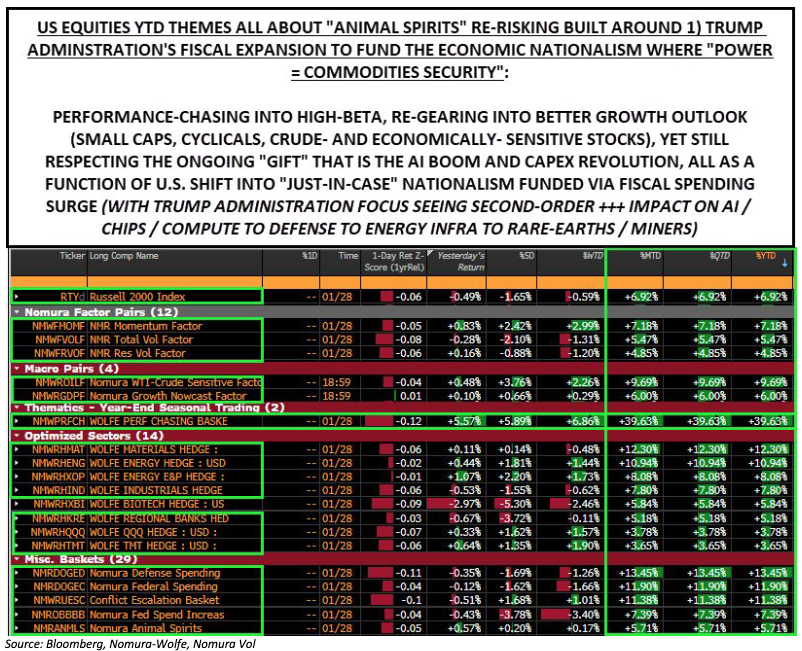

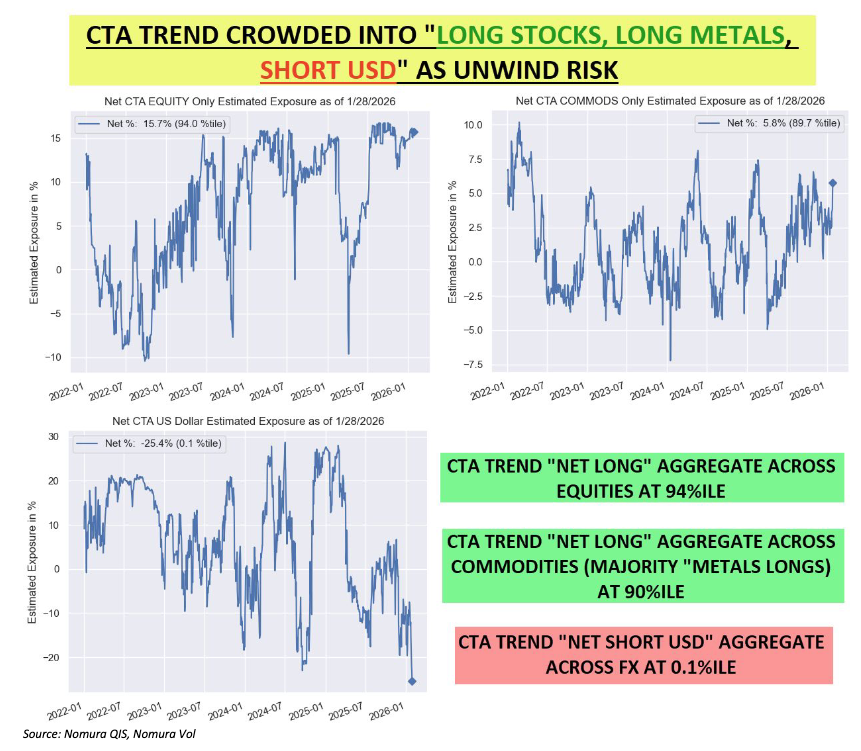

## 1) Market regime implication: crowded-long + low-vol dependence

The note’s key equity message is that systematic trend (CTA) is extremely long equities (cited at ~94th percentile). That creates a setup where:

- Upside can continue via “grind” if vol stays contained.

- Downside can become non-linear if a selloff coincides with a volatility shock, because selling pressure can move from discretionary profit-taking to systematic deleveraging into “skinny exits” (poor liquidity).

Trading takeaway:

- Treat equity index longs as short liquidity / short vol exposures even if you’re not explicitly short options.

---

## 2) What matters most near-term: “spot down, vol up” and skew

The note flags an emerging risk regime in which equities fall and implied vol rises (as opposed to the benign “spot up, vol down” carry environment).

What to watch:

- SPX/NDX/QQQ downside hedging demand increasing (skew re-steepening).

- QQQ 1-month put skew referenced around the ~85th percentile (elevated).

Trading takeaways:

- Expect hedges to get more expensive during weakness; pre-hedging matters.

- Consider hedges that reduce vega cost when skew is already rich (collars, put spreads, ratio-style structures only if you can tolerate tail risk).

---

## 3) Cross-asset correlation risk: indices tied to the “trend complex”

The note frames equities as part of a crowded bundle: long equities + long metals/commodities + short USD.

Trading takeaways for indices:

- Watch for “unwind days” where equities down, metals down, USD up. Those are the tape days most likely to accelerate index drawdowns.

- If you see broad trend complex weakness plus rising vol, assume deleveraging risk is increasing, even if spot is not yet near model flip levels.

---

## 4) The key scenario fork for US indices

The note highlights two possible paths after a hit to mega-cap tech/AI leadership:

### A) Rotation without broad de-risking (supports SPX, hurts NDX relative)

- Legacy AI/mega-cap sells, but money rotates into “everything else.”

Trading expressions:

- Prefer SPX over NDX (or value/cyclicals over pure growth).

- Consider relative trades: long SPX vs short NDX, or NDX downside hedges funded by selling SPX upside (structure-dependent).

### B) Contagion into crowded “new longs” (index downside accelerates)

- Mega-cap weakness spills into the rest; crowded trades unwind together.

Trading expressions:

- Own convexity in indices (especially QQQ/NDX).

- Reduce gross exposure; don’t rely on “it’s not down enough yet” if vol is expanding.

---

## 5) Positioning/flow nuance: CTA flip levels may be far, but vol can still force selling

He argues many CTA signals are “deep in the money” versus price-based flip triggers, so a single ordinary down day may not flip medium-term models.

But he adds the important caveat:

- Vol input alone can cause deleveraging beyond spot/price moves.

Trading takeaways:

- Monitor implied vol and vol-of-vol (VVIX-type behavior for QQQ proxies) as “sell pressure multipliers.”

- A practical rule: if spot is down and vol is up sharply for multiple sessions, treat that as higher probability of systematic de-risking even without large cumulative spot declines.

---

## 6) Practical hedge ideas for index exposure (implementation focused)

Given elevated skew risk, these are the most “note-consistent” approaches:

### For long-only equity books (SPX/QQQ exposure)

- Put spread (buy put / sell lower strike put): caps tail protection but improves cost.

- Collar: sell call to fund put or put spread; best when you can tolerate capped upside.

### For active traders expecting air pockets

- Short-dated put spreads around event clusters (earnings / macro catalysts) to target the “vol shock” window.

- If you expect rotation rather than crash: hedge NDX/QQQ more than SPX.

Risk discipline:

- Avoid naked short puts or short put spreads as “income” in this setup; the note is explicitly warning about forced selling into thin exits.

---

## 7) Tape checklist for the next unwind risk day

If several of these occur together, the note’s “profit-take becomes risk-management exercise” risk is live:

- QQQ/NDX leading downside (growth hit).

- Implied vol up meaningfully (not just a small uptick).

- Skew steepening further as spot falls (panic bid in OTM puts).

- USD up alongside metals/commodities down (trend complex unwind).

- Market depth deteriorating (bigger intraday gaps, worse fills).

---

## Takeaways to operationalize

- Keep index longs, but treat them as vulnerable to a vol-triggered air pocket because positioning is stretched.

- Hedge earlier than usual; skew can stay rich and get richer in selloffs.

- Bias hedging toward QQQ/NDX if the catalyst is “old leadership” breaking.

- Use structures that control premium outlay (put spreads/collars) rather than pure long puts if carry is a constraint.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!