SP500 LDN TRADING UPDATE 10/12/25

SP500 LDN TRADING UPDATE 10/12/25

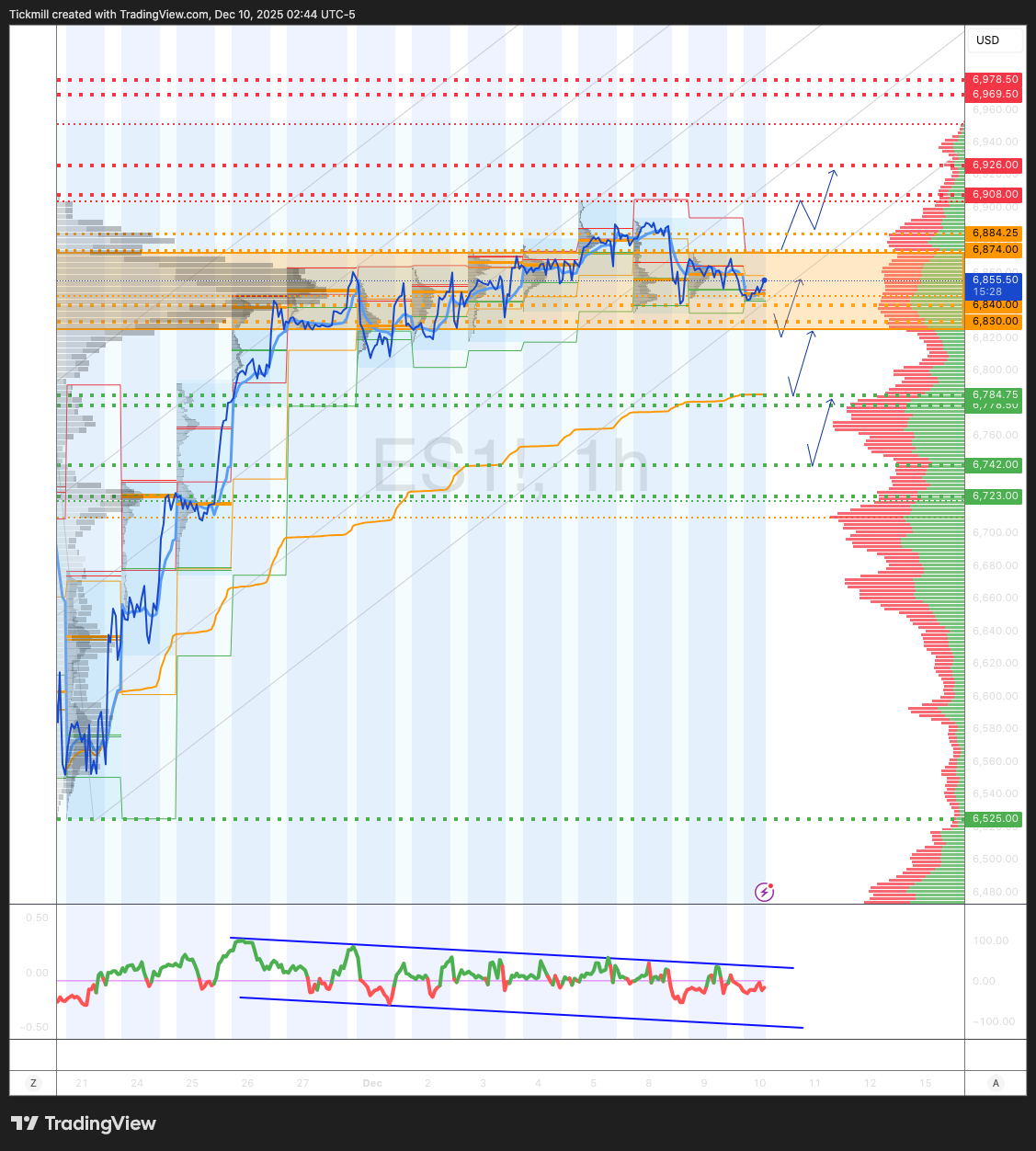

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6830/40

WEEKLY RANGE RES 6978 SUP 6778

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BEARISH 6747

MONTHLY VWAP BULLISH 6761

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6812

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is 6780, whereas we are currently at a relative peak around 6950. This indicates that dealers are typically backing the price and will be applying brakes as it fluctuates up and down

DAILY STRUCTURE – BALANCE - 6905/6820

DAILY VWAP BEARISH 6863

DAILY BULL BEAR ZONE 6874/84

DAILY RANGE RES 6908 SUP 6784

2 SIGMA RES 6969 SUP 6723

VIX BULL BEAR ZONE 18.92

PUT/CALL RATIO 1.26 ⇧

TRADES & TARGETS

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TRAGET DAILY RANGE RES

LONG ON TEST/REJECT DAILY RANGE SUP TARGET WEEKLY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

S&P closed down 9bps at 6,841 with a MOC of $2.3bn to BUY. NDX gained 16bps to finish at 25,689, R2K rose 21bps to 2,526, while the Dow declined 38bps to 47,560. Total US equity trading volume reached 14.5b shares, below the YTD daily average of 17.44b shares. The VIX edged up +1.62% to 16.93. WTI Crude dipped 83bps to $58.39, US 10YR yield increased 2bps to 4.18%, gold rose 47bps to 4,210, DXY gained 16bps to 99.24, and Bitcoin surged 198bps to $93,145.

It was a rangebound session, with volumes tracking 15% below average. Client activity remained muted, likely reflecting shifting macro narratives, caution ahead of tomorrow’s Fed meeting, year-end dynamics, and diversification from a singular theme (GS Cycs > Defs pair now up for 12 consecutive days, marking the longest streak in over 15 years). Financials saw the most activity on day one of our conference, with an optimistic tone surrounding capital markets, lending, and consumer spending. KKR projected a bottom for real estate, while BX outperformed on its significant exposure to the sector. Scattered hedge fund long demand was observed, though JPM’s worse-than-expected expense guidance tempered enthusiasm and prompted profit-taking among investors.

Floor activity was rated a 4 out of 10 in terms of overall levels, finishing +75bps to buy versus the 30-day average of -120bps. Both LO and HF skews were flat on light notional volumes. Attention now shifts to tomorrow’s FOMC presser, where most investors anticipate a hawkish rate cut. However, interpretations may vary, as the Fed is unlikely to commit strongly to a pause in January amid ongoing labor market softening. The uncertainty is heightened given the delay in employment reports, leaving participants less certain about the next meeting's direction.

In derivatives, flows were muted with market focus squarely on the FOMC. Russell reached all-time highs (~44% off April lows), prompting interest in IWM outright puts as a leveraged hedge with limited downside risk. RUT 1-month volatility remains attractive compared to NDX/SPX, offering a cost-effective entry point ahead of the Fed decision. Notable flows included 50k VIX Dec 20/25 call spreads bought for 28c (ref. 17.5). A key observation from the index desk: the FOMC straddle has only realized once in the past year, with the largest close-to-close move over the last four FOMC days being a mere 12bps. Tomorrow’s straddle closed at ~0.65%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!